Contents

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account. MACD (Moving Average Convergence/Divergence Indicator) and ADX are two of the broadest used technical indicators. Combine them together properly and you can create one of the sharpest trading systems out there.

- When the MACD line indicates opposite trend of the price chart, it is called as a divergence.

- A bullish crossover occurs when the MACD turns up and crosses above the signal line.

- Other trading indications, such as the Stochastic or RSI indicators, can benefit from the addition of MACD.

- When you know you’re on track towards your financial independence, you have less to worry about.

- Your long position would be static even though the MACD is going up.

When the MACD crosses the zero line and moves below it to become negative, a bearish centreline crossing occurs. When the 12-day EMA crosses below the 26-day EMA, this occurs. The black line is represented as the MACD line, while the line red in colour is representing the Signal line.

The full form of MACD is Moving Average Convergence Divergence. MACD is a technical analysis indicator created by Gerald Appel in 1970s. It comprises of two lines those are a fast line or MACD line and a slow line or Signal line, which moves within a upper range and lower range with a base line at the point of zero . There is a histogram graph placed at the base line which shows the difference value between the two lines. One drawback of MACD is that it acts as a short-term indicator.

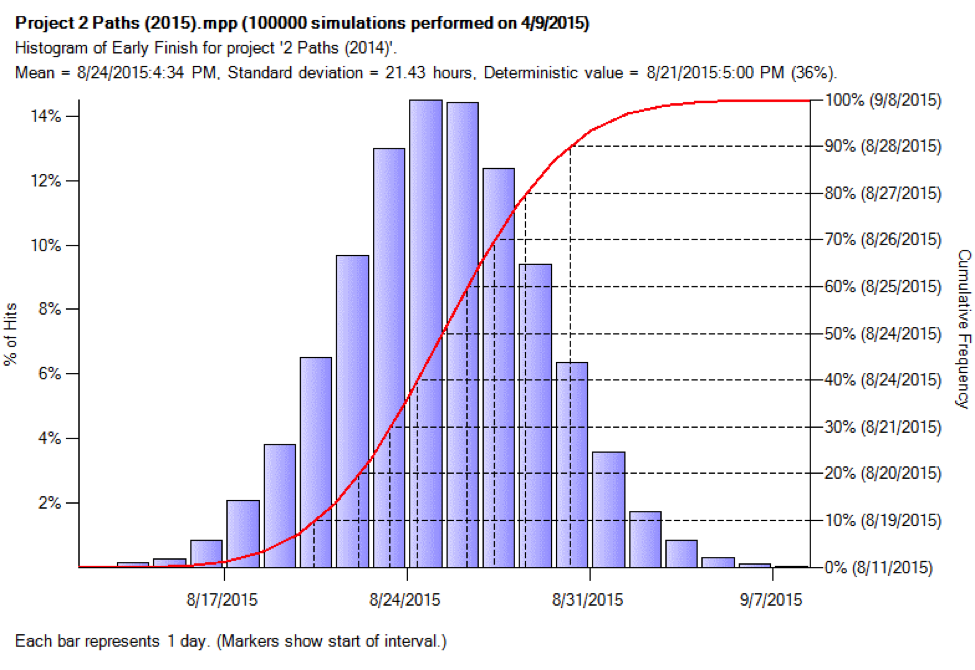

Use indicators after downloading one of the trading platforms, offered by IFC Markets. In the MACD system, it is very important to consider MACD histogram. The histogram includes vertical bars which show the difference between two MACD lines. It is above the zero line when the MACD lines are in positive alignment, meaning that the faster line is above the slower line. And when the histogram is above the zero line, but starts to move down toward the zero line, this indicates that the uptrend is weakening. Accordingly, when the histogram is below the zero line and starts to rise toward the zero line, this shows a weakness in a downtrend.

How to Read MACD?

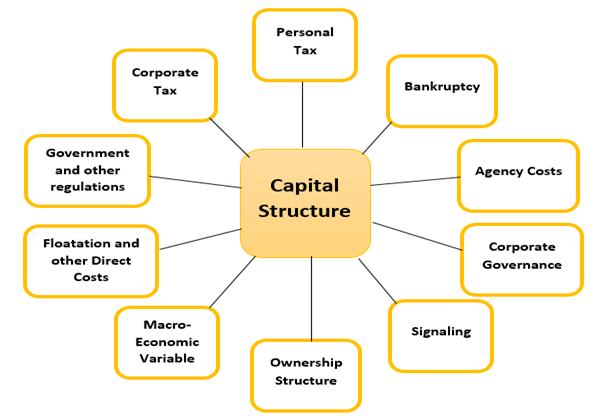

Convergence can be easily seen at the end of downtrends. Both MACD convergence and MACD divergence ought to be nearly looked as they are the most punctual indications of a conceivable change in trend and henceforth give great entry/exit signals. The crossover strategy is considered a lagging strategy because it is Difference Between Operating Leverage and Financial Leverage based on past price movements. By the time the strategy gives an indication, the price might be poised for a reversal. As such, the strategy can often produce a ‘false signal’. Based on the reading of the MACD crossovers and the convergence and divergence of the histogram, three distinct MACD strategies emerge.

This means that the hook happens when the signal and MACD lines touch each other, without crossing. The MACD hook primarily identifies the moves that are going against the trend, i.e. counter-trend within trending markets. The hook can become helpful for trading to purchase pullback during an uptrend and sell them during a downtrend. It also assists traders in identifying potential trade setups, making it quite a useful tool. As a trader, if you wish to enter a position, you should wait for the hook to materialise and confirm that the trend has indeed changed. When MACD line moves above Signal line a Buy signal is generated.

We need to understand that RSI is a leading oscillator, which means it shows the potential future changes in the price of a stock or index. The MACD is one of the most used technical indicators, and is special because it brings together momentum and trend in one indicator. Sideways or consolidation market create a lot of fake signals. A positive MACD value, created when the short-term average is above the longer-term average, is used to signal increasing upward momentum. This value can also be used to suggest that traders may want to refrain from taking short positions until a signal suggests it is appropriate.

How to use and interpret MACD?

This is called convergence because the faster moving average is “converging” or getting closer to the slower moving average. As the moving averages separates from each other, the histogram gets wider. This is called divergence because the faster moving average is “diverging” or moving away from the slower moving average. The MACD indicator will have a positive value if the 12-day EMA is above the 26-day EMA and vice-versa. A positive MACD value will indicate an increasing upward momentum. This will indicate that they should not go for a short position till the signal indicates so.

After all, top priority in trading is to find a trend, because that is where the most money is made. Spotting divergences is one of the most common and effective patterns in technical analysis. Patterns where the MACD shows divergence from prices can be an important signal although the pattern needs time to develop and should not be anticipated. Combining MACD line crossovers with other technical patterns can make the MACD system more reliable as a systems trading.

We were happy to share some useful information with you. A bearish signal presents if the MACD line falls below zero. In the latter case, 16 defines the period of the signal line while the difference between the first two numbers constructs the MACD line.

HOW TO EXIT FROM LOWER CIRCUIT STOCKS ?

When the MACD Line crosses below the Signal Line from BELOW the Zero Line, it is a BEARISH signal. It will give you great results when the trend is bearish. When the MACD Line crosses above the Signal Line from ABOVE the Zero Line, it is a BULLISH signal.

Three main signals generated by the MACD indicator are crossovers with the signal line , with the x-axis and divergence patterns. To get better results use the best combination of indicators and understand the divergence to make a trade decision according to the trend. As shown whenever the MACD indicator makes a lower high while the corresponding price makes a higher high this is the strong signal that the bullish trend is going to reverse soon. This is how you can make the use of MACD indicator to understand the market trend and to make the trading decision at the right time. And since, it is a momentum indicator, it oscillates between these two areas to give an idea about the current market condition to the traders.

Annual Report of the Company – Contents,Financial Statements,Auditors Report

The MACD is the difference between a short and long exponential moving average (usually 12-day and 26-day periods). A nine-day period’s exponential moving average of MACD, called the Signal Line, is plotted on top of the MACD to show buy/sell opportunities. https://1investing.in/ This gives MACD the characteristics of an oscillator, which results in overbought and oversold signals above and below the zero-line, respectively. A 26-day exponential moving average is subtracted from the 12-day exponential moving average.

You can see in the chart how the Nifty spiked and crashed when these lines crossed above and below the Zero lines. When the MACD Line crosses below the Signal Line from ABOVE the Zero Line, it is a POWERFUL BEARISH signal.USE IT TO TRADE IN ANY TYPE OF MARKET . When the MACD Line crosses above the Signal Line from BELOW the Zero Line, it is a POWERFUL BULLISH signal. To confirm the signal D- line of the ADX indicator higher than the D+ line. To confirm the signal D+ line of the ADX indicator higher the D- line.

Construction of the MACD indicator

Under this strategy, the MACD and the zero lines are used together to analyse the price movements. If the MACD line crosses the zero line from above, it indicates the start of a bullish market. You should buy or close your short position in such a scenario. On the contrary, the MACD line crossing the zero line from below heralds a bearish market. You should sell or close your long position in this scenario. This strategy is quite popular as it usually gives the right indications and helps traders make the right investment choices.

It also tells us about the strength of buy and sell signals. This fee is charged when you invest in a mutual fund scheme. Entry load was deducted from a fund’s NAV and was generally fixed at around 2.25% of the investment value. Since 2009, SEBI has abolished the entry load on mutual fund investments. Submit the KYC, Getting Your KYC done is mandatory for all first time mutual fund investors.